As well as a range of syndicated reports, our maritime team also offers a maritimer tracker service, which is designed to keep those with a vested interest updated on installation activity and key trends. Our clients are provided with the latest data on a quarterly basis throughout the year.

In our latest update, we amassed a total of 3,280 ship owners. This tallied to 21,648 vessels globally, increasing our vessel count by ~5,000 from the previous update. However, with the removal of vessels that do not have active VSAT connectivity, such as laid up, storage, new builds or inactive vessels, our total figure decreases to 19,023 vessels. This service is useful for understanding how each maritime service provider (ISP) customer footprint is laid by each key application and subsegments.

We should highlight that the predominant increase in our vessel count from the previous edition is due to reviewing Clarkson’s World Fleet Register.

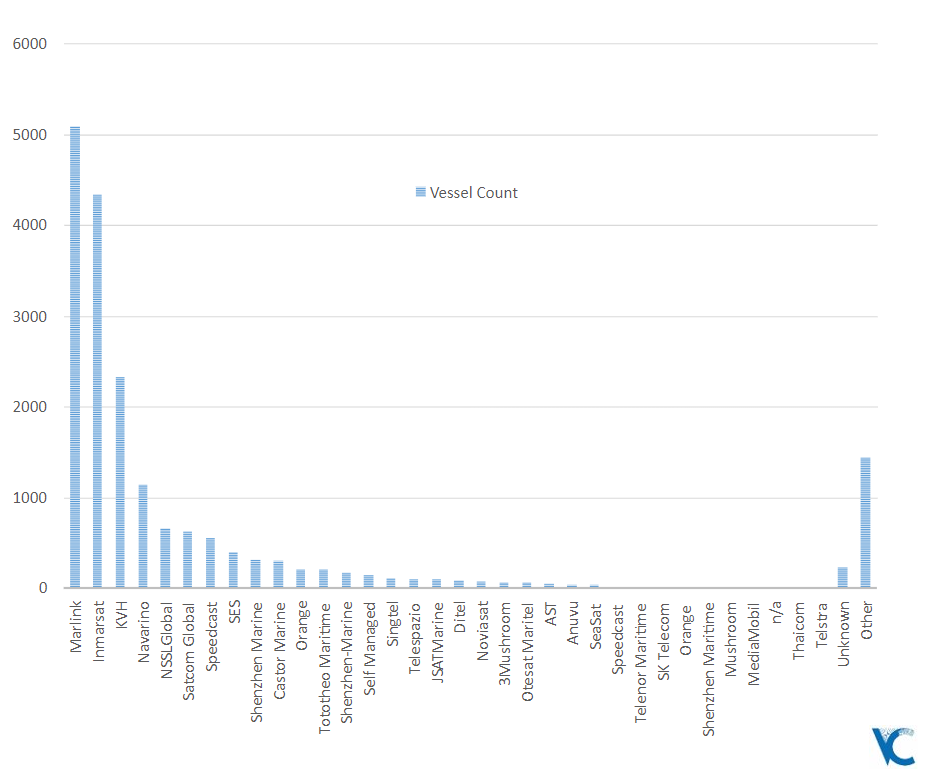

In our latest data collection update, Marlink retook the top spot in our sample, for the overall sample size with market, tallying 5,089 vessels. Inmarsat was in second spot, with its direct retail business, Inmarsat Solutions, at 4,340. The company continues to grow its FX customer base, and vessel subscriptions totalled around 15,700 worldwide at the end of August. Our biggest jump in vessel count, relative to the total count in the previous edition, was KVH. Which totalled 2,332 vessels in our data collection. Additionally, we also found a number of new South-East Asian shipping companies using KVH services.

Another interesting point: we managed to find some vessels served by Ditel Technology, the biggest Chinese service provider. The number of vessels served by the Chinese ISP range from 5,000 to 30,000 vessels depending on your source. In our collection, we found 94 vessels.

The one surprise from this sample collection was Navarino placed in 5th position. In some of our interviews with end-users, many have reported being Navarino customers and highlighted the strong customer support the service provider provides. Additionally, its value-added services of Infinity and Spectrum were much appreciated and utilised.

Lastly, we collected 432 vessels using Starlink LEO services. The two biggest segments were merchant and ocean cruise vessels. The merchant market accounted for 299 vessels, a number highlighted in the commentary sections of this document. The second largest segment was the ocean cruise market, with 119 vessels. These vessels would be primarily served by Speedcast, Anuvu, and now SES on its O3b service.

On reflection, the number of vessels using Starlink worldwide would probably be greater than 7,000 as of today. We have a dedicated Starlink Maritime report which readers can purchase, please email info@valourconsultancy.com and insert “Starlink Maritime” in the subject line.

For more information about our maritime tracker service, please click here.