In June 2023, I published Valour’s first study focussed on The Future of Flat Panel Antennas destined for Comms-On-The-Move (COTM) applications (aviation, land and maritime). One of the primary objectives of the study was to identify which of the many vendors developing electronically steered antennas (ESAs) would go on to succeed. At the time, more than fifty companies were estimated to be developing a flat panel antenna, with at least half working on technology intended for COTM applications. Knowing which vendor would go on to become an established brand in this space and achieve a majority market share was challenging because so many of the ESAs were still in development.

At this point, I’d like to take a huge side-step but bear with me. As a big San Francisco 49ers fan based in Australia, I’ve grown extremely fond of the Rich Eisen show, a daily sports show and podcast now operating under the ESPN umbrella. One of the show’s regular segments is the Power Rankings, which involves Rich putting his neck on the line every week and declaring his opinion on the top 10 teams in the National Football League (NFL). It stimulates a wealth of discussion from far and wide because until the super bowl winner is declared in February of next year, there is no right answer; it’s an opinion. He acknowledges this caveat in the opening credits of the segment, with a voice over declaring “Power Rankings. There are many like it, but this one is mine”.

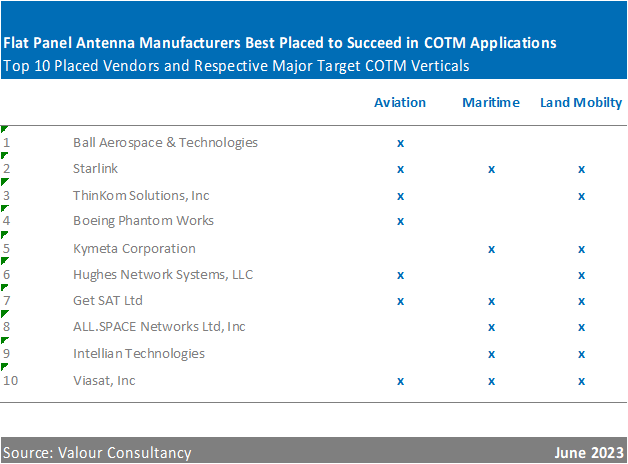

Why do I bring this up? Because the 2023 Flat Panels report contains a power ranking of its own and just like Rich’s, there are many opinions out there, but this one is mine! (I told you it would come together). My assessment of the flat panel competitive environment involved scoring each vendor against a series of factors we felt were influential to achieving longevity and market share. The assessment allowed us to rank the flat panel vendors and build the “Power Rankings” list. The results are shown in the table below.

Eighteen months later and we’re now writing the second edition of the Flat Panel Antennas report. The intention is to refresh the power rankings of 2023 and I’m looking forward to doing so with my colleague Arabella who has unknowingly joined the power rankings committee. Ahead of that, I’d like to revisit the previous rankings by checking in on a select few of the featured vendors to see how the initial projections are holding up.

Number 1 – Ball Aerospace & Technologies

Acquired by UK based, BAE Systems for $5.6 billion USD in February 2024, with 5,200 employees and manufacturing facility incorporated into BAE’s new Space & Mission Systems business unit. The acquisition adds substantial commercial clout and manpower with the intent to do even more within the government and defence sectors. BAE Space & Mission Systems continues to deliver sub-arrays for SES’s Ku-band ESA that supports multi-orbit connectivity on the OneWeb network. With a reported backlog of more than 1,000 aircraft, this hardware is the prime contender to Starlink in the commercial aviation sector right now.

Status: Remains well positioned, strategically, but has it done enough to sustain top spot?

Number 2 – SpaceX

Dominant – That is the only word one can use to summarise SpaceX’s performance in the last 18 months. At the time of writing, it has almost 4,000 aircraft under contract in the commercial aviation sector, tens if not hundreds of thousands of kits installed on vessels in the maritime sector, a strategic partnership with John Deere, connected trains across North America and Europe, as well as kit deployed on military vehicles and aircraft, globally. Whilst Amazon Kuiper will give end-users an alternative option in the Ka-band, there is still a 24-month window for SpaceX to build on what is an already enviable position.

Status: The benchmark and vendor everyone has their sights set on for 2025 and beyond.

Number 4 – Boeing Phantom Works

Phantom Works’ ESA was expected to feature on the MQ-25 stingray re-fuelling drone but at the time of writing remains elusive. Competing technology has always been a threat to Phantom Works ambitions in the connectivity hardware arena, but perhaps never more so than today, with lower priced, high performance and increasingly open alternatives now readily available on the market.

Status: Established position in military segment, but is ESA development still a priority, and if so, can it hold off dynamic newcomers?

Number 7 – Get SAT Ltd

In May 2024, Get SAT was brought under the Thales umbrella, along with its portfolio of satcom antennas. The French company cited the need to compete with Starlink in strategically important military markets via open hardware and we’ve observed a substantial shift in this direction from Get SAT. The company remains engaged with Airbus on the OEM’s HBC+ program but priorities have seemingly shifted to the defence sector. In late September, SES informed the FCC of its intention to leverage Get SAT’s LESA Blade Ku airborne terminals as part of testing on Intelsat and Starlink satellites which I assume is linked to servicing government interests.

Status: I had expected Get SAT to really do well in the commercial aviation sector after so much hype from the HBC+ program and was worried when things slowed. However, I am not alone in seeing multi-orbit antennas as the future in the government and defence sector and it looks like Get SAT, with Thales behind it, could be one of the vendors to benefit.

New entrants

With only 10 spots available in my power rankings, there’s going to be some notable names that did not feature last time but could shake things up this time around. Cesium Astro is most certainly one of them, having made itself known in the latter stages of publication for the 2023 report. The Texas-based company has been a constant at trade events around the world and its name as cropped up in numerous interviews carried out as part of the 2025 update. Cesium is looking to compete in the government and defence sector through its Skylark solution in a similar fashion to Get SAT, via an open architecture that connects to any network. Could it make the top 10 this time around?

To find out who are the movers and shakers in the new-look 2025 flat panels power rankings you’ll have to obtain a copy of the new report, which is due to publish later this year. Will it stimulate debate on the scale of Rich’s NFL power rankings? It shouldn’t, but there’s a lot of interest in this area right now and for that reason, I can’t wait to share notes!

To download our report proposal or to participate in our final round of market research interviews, please click here. Our free participant programme offers a range of exclusive benefits including an invitation to a post-publication webinar where we’ll share key findings from the research.