11/26/2025

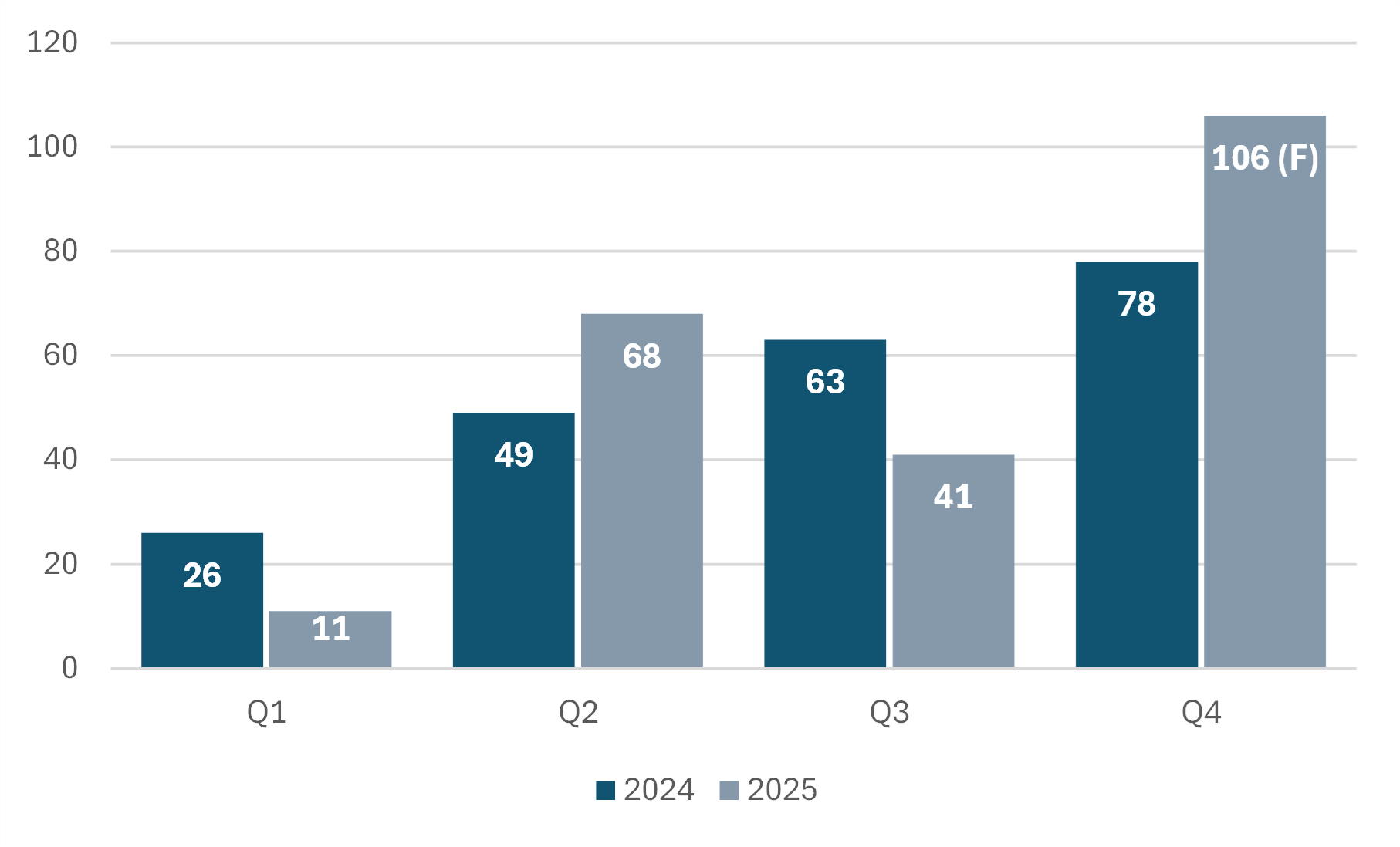

EHang today released its Q3 2025 results, revealing that it delivered just 41 units of its EH216 series eVTOL – down from 68 in Q2 2025. The figure is also a sharp reduction from the 63 units delivered in Q3 2024, meaning EHang has now produced 120 units across the first three quarters of 2025, compared with 138 in the same period in 2024.

Year-to-date revenues stand at RMB 265.7 million (approximately USD $37 million), and the company has maintained full-year revenue guidance at around RMB 500 million. In practice, this means EHang expects to generate roughly RMB 234.2 million in Q4 2025, implying deliveries of around 106 EH216 units in the final quarter (based on year-to-date average selling prices). That would bring 2025 production to 226 units – a modest increase on the 216 delivered in 2024, and a dramatic reduction from the 426 units implied by the RMB 900 million guidance the company issued as recently as May in its Q1 2025 update.

Quarterly EHang EH216 Production in 2024 and 2025 (Left) and Between 2022 and 2025 (Right)

Source: Valour Consultancy

Quarterly volatility is one thing, but a year-on-year decline in Q3 output combined with a full-year target that only slightly exceeds last year’s total suggests EHang’s early-stage momentum in the sightseeing and tourism segment may be flattening. Expected Q4 production, which effectively requires the largest quarterly unit jump in the company’s (albeit brief) history – places heavy reliance on year-end municipal purchases and bulk deliveries landing exactly on schedule. And the rapid downward revision of full-year guidance from RMB 900 million to RMB 500 million within two quarters is particularly telling. It implies weaker-than-expected domestic demand, slower provincial procurement cycles, or operational bottlenecks that have limited throughput at a time when China’s low-altitude-economy policy should, in theory, be accelerating adoption.

Indeed, EHang without question, operates in what should be the most favourable set of market conditions for eVTOL deployment anywhere in the world. Beyond the generous low-altitude-economy-related subsidies, China is home to multiple congested megacities and has already built out a growing network of vertiports. What’s more, EHang’s aircraft has a suggested retail price of RMB 2.39 million inside China (approximately US$330,000) which is over an order of magnitude below Western eVTOL programmes. The platform is also autonomously operated, which should translate to significantly lower operating costs per seat-mile.

For the wider passenger AAM industry, the signal is equally uncomfortable. EHang remains the only company globally delivering a certified, commercially operating eVTOL at even modest scale. And while its current deployments are focussed on sightseeing rather than true intra-city air taxi services, the fact that its production curve may be plateauing – despite regulatory tailwinds, political momentum, and a comparatively simple, autonomy-first design – suggests that near-term demand for short-hop passenger operations could be more limited, more seasonal, and more dependent on government-linked buyers than many forecasts assume.

The fact that EHang still cites, in its latest investor presentation, a report forecasting 100,000 air-taxi and personal eVTOLs operating in China by 2030 only reinforces how detached some industry narratives remain from real-world market behaviour. To put this into perspective, the same presentation shows the airport shuttle as a use case for its eVTOL, which is surprising given the EH216-S has a certified two-passenger limit, a maximum payload of around 220 kg, no dedicated baggage compartment, and an effective range of roughly 22 miles – making it inherently limited in terms of mission diversity. While the forthcoming VT-35 aims to extend range, broaden mission scope and introduce a dedicated luggage compartment, it remains a two-seat design and is not yet certified.

With EHang’s stock currently at $13.43 at the time of writing – its lowest close since July 2024, it is reasonable to ask whether the wider sector is experiencing the broader correction described in CleanTechnica’s recent analysis of eVTOL valuations. That piece argues that falling share prices across multiple Western OEMs reflect investors reassessing the realities of certification, infrastructure and battery-powered vertical flight – a context that makes EHang’s own slowdown look less like an anomaly and more like part of an industry-wide reset.